For both personal and business […]

Resources

20 posts

Preface We assume you have […]

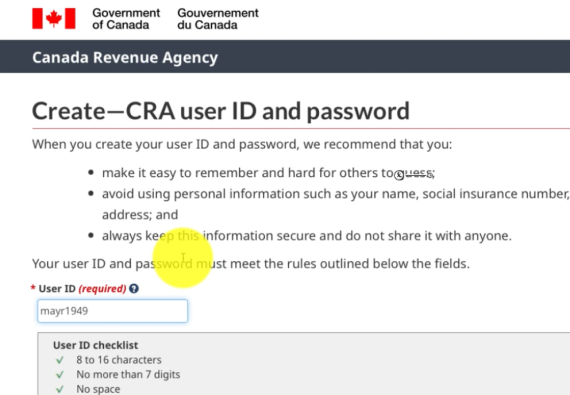

Use key word “cra my […]

Good to know: If you […]

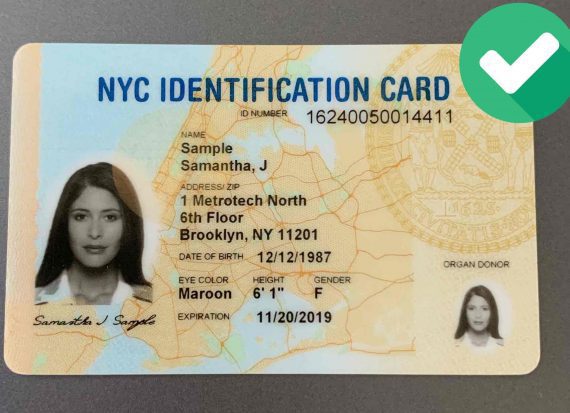

When you provide us a […]

[…]

Self-employed and small business owners […]

In macOS environment, please go […]

Prior to working on your […]

Instruction You can send us […]

As a technology-driven accounting firm […]

Regardless if you use Apple […]

If you use Apple mobile […]

On many occasions we will […]

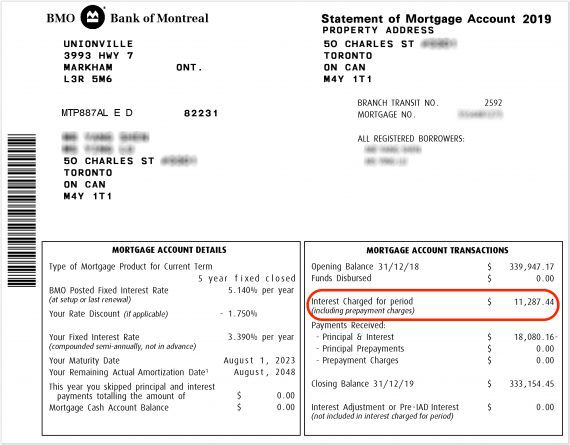

Vist CRA’s website CRA My Payment […]

Please visit website CRA My Payment to […]

Please refer to the following […]

Visit CRA’s website CRA My Payment […]