To our individual clients, we normally charge our service fees by the job item. To our corporation clients, we provide the following 2 fee schedules:

- By job item

- By the hour – 15min as a minimum billing unit

All of our fees are directly proportional to our accountants’ hours spent. Please refer to the following chart as our fee schedule for the current year. When we charge by job item, we will first give an estimate to the time consumption of the accountant, followed by a “packaged” flat rate quoted to the client for the entire job.

| Service Category | Our Rate |

|---|---|

| Consulting | Please see our consulting fee schedule |

| Bookkeeping | $80/hour |

| Tax accounting for individual and corporation | $200/hour |

| Terminal tax filing and/or estate tax filing | $400/hour |

| Tax planning on merge and acquisitions, corporation architectural design, share transfers, shareholder agreement, etc. | $400/hour |

For example, the tax filing package we provide to our corporate clients includes the T2 return, HST return (if applicable), and up to two T4 slips in the next February.

Other tasks such as bookkeeping, payroll, monthly and quarterly reports, CRA verification, etc., are the items that are charged according to the actual time used. You can refer to the following sample agreement we have with our corporate clients.

We accept electronic funds transfer, email transfer, and cheque payment only. All charges are subject to HST.

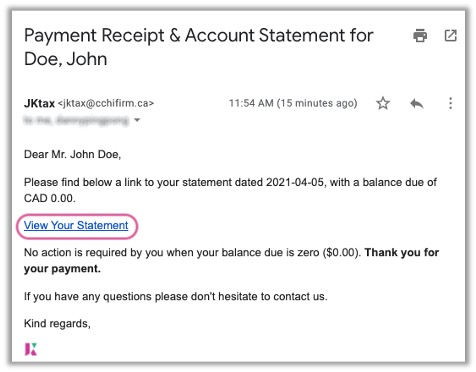

Invoicing & Payment

Please send your e-mail transfer payment to:

payment@jktax.ca

Please kindly include the invoice number in the message field when doing so in your online banking.

When you use one EMT transaction to pay us multiple invoices, you can mention just one invoice number in the message field.

If your daily EMT limited is less than the total amount so you will need to split the payment into several days, no worries. Our system will acknowledge your partial payment and send you a receipt after each payment is received.

When you use Direct Depoist in your online banking to pay us, please use the following financial information of ours:

- Institution # 003 (RBC)

- Branch # 01334

- Account # 1005016

Please also kindly add payment@jktax.ca in the payment notification field when available.

Surely we accept traditional cheque. Please use registered mail to mail the cheque to our office address.

If you would like to drop by the cheque to our office yourself, please call our office in advance to make an appointment.

A possible more connivance way is that you can step into any RBC branch and ask the teller to deposit the cheque into our bank account.

You can also try to help us to use the mobile phone to deposit your cheque:

- Make the cheque with clear writing or printing

- Take a photo of the front and back of the cheque, please make sure the background stands out and you leave enough border in the picture

- Send us the two pictures with their original size

- We can deposit your cheque by taking photos at our screen

- Normally you will receive the payment receipt in 6-7 business days as the cheque needs to be cleared with our bank account